Setup GST Tax in woocommerce store

If you have a woocommerce store then you have to add GST taxes on products.So follow the steps for setup GST in Woocommerce Store .

Step 1) Goto woocoommerce -> Click on settings -> check the box for enable taxes -> save settings.

Step 2) Click on TAX tab on the top -> Enter into additional tax classes -> Enter tax slabs one by one -> as described in the image ->save settings

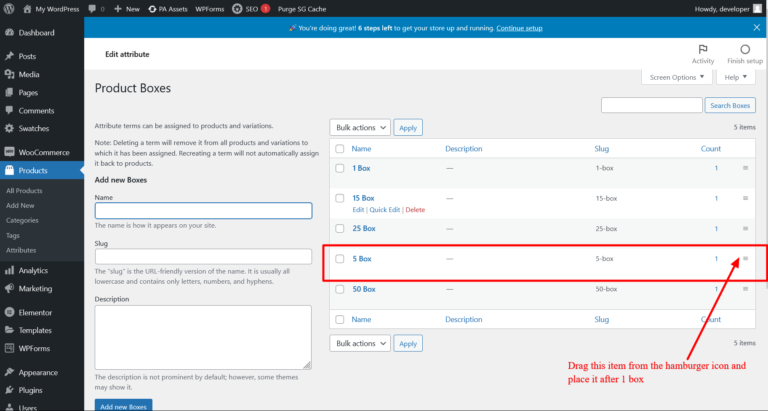

Step 3) Click o n 5% GST tax slab option -> Here you will see a table where you have put some codes as follows:

a) Country Code -> IN

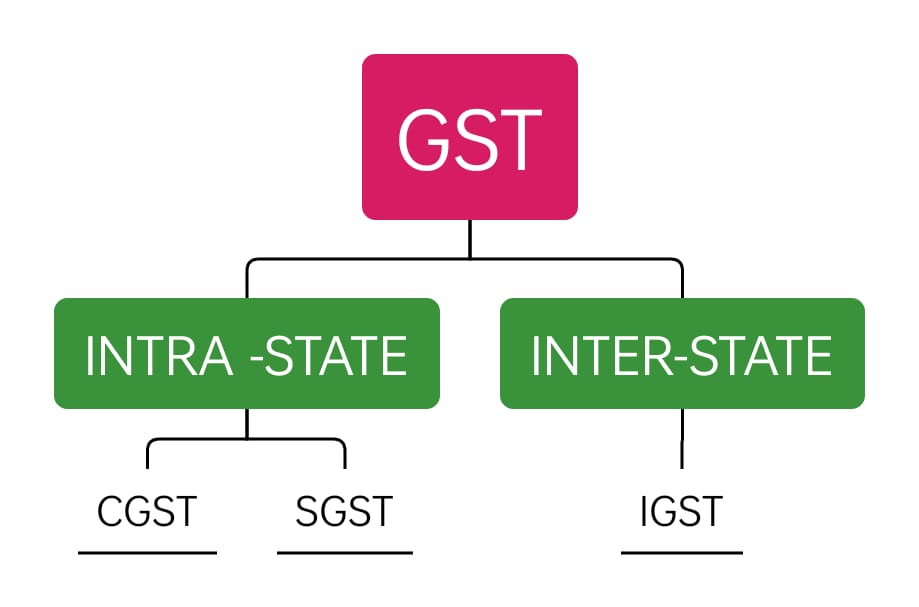

b) State Code -> HR(HARYANA) state code in which you are running your business . This is for Intra-state GST

c) Rate % -> 2.5% for (CGST) priority(1)

d) Rate % -> 2.5% or (SGST) priority(2)

e) State Code -> GJ(GUJRAT) different state where someone buys products . This is for Inter-state GST

f) Rate% -> 5.0% for (IGST) priority(3)

Step 4) After save this table

Goto -> products -> edit any product -> in general section -> add tax class to product as described in the image -> select GST5% -> save product.

Step 5) Goto -> shop > add to cart some item -> and click on check out page -> you will see -> if some buyer from the same state then 2.5%(CGST) and 2.5%(SGST) will be added to order total.

Step 6) When some buyer from a different state then IGST (5%) will be applied.

Watch This video for more more details